7 Steps for Setting Up a Business in The UK

If you’re tired of working for someone else but have a great idea you know will be a hit, you’re an excellent candidate to start your own business. If you googled how to set up a business in the UK, you’ve already taken the first step in the right direction. If you’re still unsure, we’re here to clear it all up for you!

More and more people are discovering the freedom of being self-employed and running their own business. In fact, in recent years the number of startups in the UK has been on the rise. If you’re looking to set up a business in the UK, it can seem like a stressful ordeal. But don’t fret. We’ve put together a short checklist to help you. This list is not exhaustive, but it’s a great starting point to make sure you have everything ready to open your doors and bring your dream business to life.

1. Check if you’re legally able to start a business

If you are not a natural citizen of the UK, you need to make sure your immigration status allows you to set up a business. If you have an incorrect visa, you won’t be able to complete all the paperwork. The type of visa also depends whether you immigrated to the UK and are looking to set up a business, or if you’re wanting to set up a business in the UK, but are not a citizen and don’t plan to become one.

2. Decide on a legal structure

When you register your business, you’ll find there are a few different ways to run it:

Sole Trader - You’re self-employed and run your own business. Under this structure, you are the only person responsible for any debts, and you can keep any profits after tax. As a sole trader, you can fill out a Self Assessment Tax Form.

Partnership - You and a partner (or partners) own and run the business, are equally responsible for any debts and share any profits after tax. You and your partners are liable for each other’s misconduct or negligence, should there be any. You’ll need to choose a ‘nominated partner,’ which is the partner responsible for managing the partnership’s tax returns and keeping business records.

Limited Partnership - You need to have one ‘general partner’ and one ‘limited partner.’ General partners are liable for any debts the business can’t pay. They also control and manage the business, can make irreversible decisions for the company, and can apply for your business to act as an authorised contractual scheme (ACS). A limited partner contributes an amount of money or property to the business when it is set up, and is only responsible for debts up to the amount that they provided. They can’t manage the business, and can’t remove their original contribution. A partner can be a person or a company.

Limited Liability Partnership (LLP) - In this partnership, the partner’s liability is only related to how much money they invested in the business. You ‘incorporate’ a limited liability partnership to run the business with two or more members, known as a ‘corporate member.’ You pay taxes on your share of the profits, but you aren’t personally liable for debts the business can’t pay.

Private Limited Company - This type of business is privately managed, owned by shareholders, and run by directors. There are two types of companies

Limited by shares - This type of business usually makes a profit. For this, the company needs to be legally separate and have separate finances from the people who run it, have shares and shareholders, and can keep any profits after tax.

Limited by guarantee - This type of business is usually ‘not for profit'. Like a limited company by shares, it needs to be legally separate and have separate finances from the people who run it. Still, the difference is this business needs to have guarantors and a ‘guaranteed amount’ and invest any profits back into the company.

3. Choose a business name and location

Every business needs a name and legal location for tax purposes. If you’re a sole trader and work from home, your business’ address will most likely be your home address. But if you run a business located outside of your home, you will use that address. There are different rules for naming your business based on the structure you have chosen, so check those rules on the gov.co.uk website after you’ve chosen your structure to make sure your name complies. As a general rule of thumb, you’re not allowed to choose a name that’s already been taken. Remember, also, you can call a brand anything you like under your business name.

4. Write an eye-catching business plan

Whether you’re seeking funding or not, a healthy business plan is crucial to success. It’s your business’ roadmap and can help you grow your company in a structured way. Also, if you need funding, a business plan is essential to secure that funding, whether you’re looking for investments or credit. To find out more, we’ve written an Amaiz guide (and provided a template) to help you: How to write a business plan

5. Make sure you’re insured

As a business, you’ll need insurance to protect against anything that might happen, such as theft, legal fees, accidents, and more general risk. The coverage and policy you choose depends on factors like what kind of business you have and how it’s run. Sole traders don’t need the same type of insurance as a Ltd company, so you’ll want to consider what kind of coverage you need based on your business. And you’ll want to get some insurance quotes before you settle on a policy.

6. Set up a business bank account (and think about an accountant)

Setting up a business bank account will be necessary for most business types if it is a separate entity to you. If you’re a sole trader, this doesn’t apply, although you’ll need to keep strict books to file your taxes for your business, so we still recommend opening a separate account for your business. You’re welcome to do your books yourself, but if you have a more complicated money flow, hiring an accountant might be the most sensible option. If your company is bigger, you might need to hire accountants by default. Accountants also help when tax season comes around, which brings us to the next point.

7. Get everything squared away with HMRC!

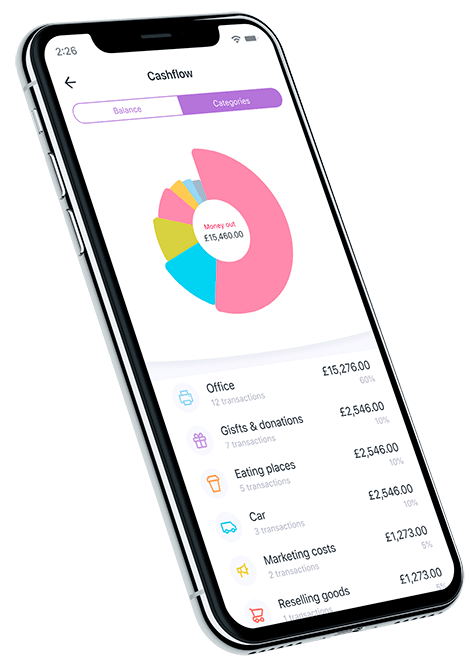

There’s no way around it; you’ll have to register with Her Majesty’s Revenue and Customs for tax purposes. The good news is you can now do everything online, which makes it easier to sort out! And if you choose an Amaiz account, not only are your expenses categorised in our app, you can also automatically set aside part of your income for Self Assessment tax in a second Jar account - meaning you save as you go.

Besides these seven steps to starting a UK business, there are a few other things you might need to do, depending on your business. Make sure you hold any licenses or permits should you need them in your industry, and consider any regulatory issues such as health and safety. Many nuances go with starting a business, so it pays to be thorough and to do your research! Setting up a UK business is an exciting and rewarding adventure, so start ticking these seven steps off your list - and remember - each one brings you closer to your goal!

Download now!

And you can open a business account with all the support you need in minutes.