Making Tax Digital: What is it and how will it affect your business?

Her Majesty's Revenue & Customs' digital campaign is warming up. Here's our introduction to the changes you can expect from Making Tax Digital.

The name is very deliberate. HMRC's aims are very much to make tax digital; to modernise tax paying in the UK and to establish one of the most digitally advanced tax systems in the world.

This isn't just a case of future for future's sake. Billions of pounds are lost every year due to inaccurate tax calculations, and that has implications for taxpayers and HMRC. This stride to the future intends to make tax:

- more effective

- more efficient

- easier for taxpayers to get right

What is Making Tax Digital (MTD)?

It's a programme of tax reform that will make tax filing and payment entirely digital. It's intended to create a seamless connection between a business and HMRC, where tax is part of everyday business processes and planning. All companies will be required to adopt systems that digitally communicate and receive tax information between them and HMRC.

Isn't tax already digital?

It's unlikely you're avoiding all things digital when you file your tax return, even if you're keeping things as pen and paper as you can! MTD means the elimination of manual reporting, and the timing and calculation errors that come with it, so there's no doubt things are going to become more digital. Increased digitisation is an inevitable part of modernisation, and presents many benefits to HMRC and your business.

What are the key features of MTD?

Under MTD, business owners won't be able to upload their records to HMRC's website manually. Digital records of taxes must be kept and uploaded using MTD compatible software which can record and retain company data as well as deliver and receive information with HMRC using API.

So, it's the end of submitting records to the HMRC's website. Instead, the information will be transferred through tax summary updates every three months.

When will MTD happen?

The first phase has already begun. All VAT-registered businesses with a taxable turnover of more than £85,000 are now required to follow the rules for 'Making Tax Digital for VAT' by keeping some records digitally unless they have successfully applied for an exemption.

From 1st April 2022, all VAT registered businesses must sign up, no matter their earnings.

All self-employed businesses and landlords with annual business or property income of £10,000 or above will need to follow the rules for MTD for Income Tax from their next accounting period starting on or after 6th April 2023.

So dates are changing?

No, it's important to note that these changes are digital and process improvements that do not affect financial deadlines. For instance, the 31st January date for finalising tax affairs remains, even if you provide HMRC tax summaries on a more frequent schedule.

Are there any exemptions?

If you believe the changes are incompatible with your business due to extenuating circumstances, including location, disabilities or religious beliefs, contact HMRC as soon as possible.

Will there be penalties?

Companies that fail to comply with the initiative by the correct deadlines will be subject to penalties, and you can see the latest penalty proposals here. However, HMRC recognises that this is a significant shift for many businesses and will favour support and leniency during the transitional phase. If you're encountering any issues or can already see trouble ahead, make sure you keep them informed.

What do you need to do now?

Making Tax Digital requires digital bookkeeping and software integration. Now's the time to get ahead.

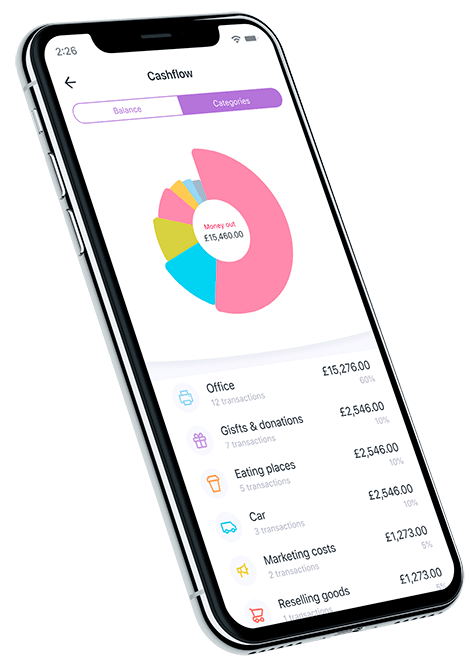

If you're not already keeping digital records, you should start. The Amaiz app lets you attach receipts to your expenses and transactions as you go, so you're already ahead without having to take too much time out from your work. With MTD's new schedule, you need to keep your records as up-to-date as you can, and not let admin pile-up.

A cornerstone of MTD is adopting compatible software if your business does not already do so. That doesn't mean you have to commit to a single or expensive solution, though. You can opt for a complete package or a combination of linked products if that better suits your business. The important thing is that the right data is sent to HMRC in the right way.

Take a look at this HMRC-prepared list of software capable of both keeping and submitting tax records.

You may well already be using software and taking advantage of the integration with Amaiz that allows you to pick up your digital records for filing your accounts.

How soon can you sign up?

Right now, HMRC is looking for a wide variety of companies to volunteer for its pilot scheme before the full scheme launches in 2023.

You must be a UK resident, registered for Self Assessment with income from one business, and with up-to date returns and payments. If you're currently receiving any government support due to COVID-19 its likely you won't be eligible at the moment.

Check your eligibility and sigh up at Gov.uk.

Download now!

And you can open a business account with all the support you need in minutes.