Knowing your tax allowances before 5th April

The current tax year ends on 5th April 2020. If you’re self-employed, time is running out to make the most of the tax allowances you could be eligible for.

Planning ahead is key to maximising your tax allowances and reducing the amount you are liable for within this tax year, but there’s still time to check. Your tax liability changes depending on a number of factors. If you're a higher-rate taxpayer (with a total income exceeding £50k), both pension contributions and charitable donations can reduce the amount of tax you pay.

Make donations to charities

You can receive additional tax relief as you support good causes, especially if you are a higher-rate taxpayer.

Registered charities are able to claim gift aid on most donations you make to them. For every £1 you donate, a charity can claim 25p from HMRC, effectively increasing your donation to £1.25. For example, if you donated £1k in a year to a charity, that charity would be able to claim £250 in gift aid from HMRC.

If your total income exceeds £50k, you can claim on donations made to registered charities during the tax year under the gift aid section of your Self Assessment. Anyone paying 40% tax on their income can claim further tax relief at £250 (£1250 x 20%) when they submit their Self Assessment.

Power up your pension

If you’re a higher-rate taxpayer, personal pension contributions could offer the greatest tax breaks.

If you’re a small business owner trading as a LTD company you should arrange and contribute to your own personal pension. If you’re a sole trader you will already be making state pension contributions through normal channels, but it’s worth considering topping this up with a personal pension.

Did you know you are eligible for full tax relief on any personal contributions you make to a registered pension provider at the highest rate of tax? You just need to complete the pension section of your tax return to register it.

For example, if your income from all sources is £55k, you are liable to pay 40% income tax on £5k of your income (above the £50k threshold). If you were to contribute that £5k to a personal pension within the tax year, you’d be able to claim additional tax relief on your Self Assessment:

- The total paid to pension: £5k

- The amount claimed from the government by your pension provider and added to to your pension pot: £1,250

- The amount your total tax liability is reduced on your tax return: £1,250.

How Individual savings accounts (ISAs) can work for you

ISAs are a great way to save money for the future as they accrue tax-free interest up to a certain amount. The maximum you can save in an ISA during the current tax year (2019/20) without paying income tax is £20k.

However, if you pay money into an ISA and then decide to withdraw some or all of the money, you may lose some of that tax-free allowance depending on whether your ISA is flexible or not. For example, if you added £10k to a non-flexible ISA and then withdrew £3k within the same tax year, you will only be able to top up your ISA with a further £10k (two additions of £10k each).

If you haven’t already made full use of your ISA allowance, you should top up your ISA by 5th April 2020 to take advantage of your full allowance. You can use that ISA allowance however you like. You can save £20k into a Cash ISA or you split the £20k between cash (savings accounts), stocks, shares, ISAs or innovative finance ISAs.

Factors affecting child benefit tax

If your taxable profit from self-employment or paid employment is above £50,000 and you claim child benefit, you will pay the high-income child benefit tax. For income between £50k and £60k, you will pay 1% of the total benefit charge claimed for every £100 of your income over £50k. But if your income is above £60k you will have to pay back everything claimed as child benefit.

Usually, the high income child benefit charge falls to one relevant taxpayer (with the highest income). HMRC have produced a tax calculator which shows you how much of the high-income child benefit charge you are likely to pay.

Our expert’s top tips for navigating these tax allowances

- If you are a higher-rate taxpayer eligible for the high-income child benefit charge and are donating to charity or paying money into a personal pension, don't forget to declare the latter two on your Self Assessment. This will reduce the amount of high-income child benefit you pay.

- Remember that the high-income child benefit charge is based on your ‘adjusted net income’ (after pension contributions and charitable donations have been deducted). If this adjusted net income falls below £50,000, you won’t have to pay the charge.

For example, if your total income is £60,000, you will be required to pay back any child benefit that you’ve claimed in full. But if you gave £11k to a charity, your adjusted net income will be £49k and as a result, you may not have to pay the high-income child benefit charge.

Regardless of whether you claim child benefit or not, the golden rule is: if your total income is above £50k, paying money into a pension or donating to a registered charity is likely to reduce your tax liability.

Don’t forget dividends

If you are a shareholder with dividends payable, these are the rates you need to be aware of for the 19/20 tax year:

| Tax Band | Tax Rate | From | To |

| Basic Rate | 7.5% | £0 | £37,500 |

| Higher Rate | 32.5% | £37,501 | £150,000 |

| Additional Rate | 38.1% | £150,001 | - |

A dividend allowance of £2k is in place for 2019/20, which effectively means that the first £2k of dividends are tax free. If you haven’t withdrawn any dividends this tax year or have so far taken less than that threshold, you won’t have to pay any tax on dividends up to that amount. This limit applies to each shareholder in your company.

We appreciate that most shareholders cannot afford to keep their dividends to a £2k limit, but a sensible tax strategy could be to fill your basic rate band with dividends, paying 7.5% up to the higher rate limit. Just don’t forget that dividends are counted as the top slice of your income, so any other income will be taken into account first and could push your dividends into the higher rate band and that tax rate of 32.5%.

Also remember that you must have available profits in your company to pay additional dividends.

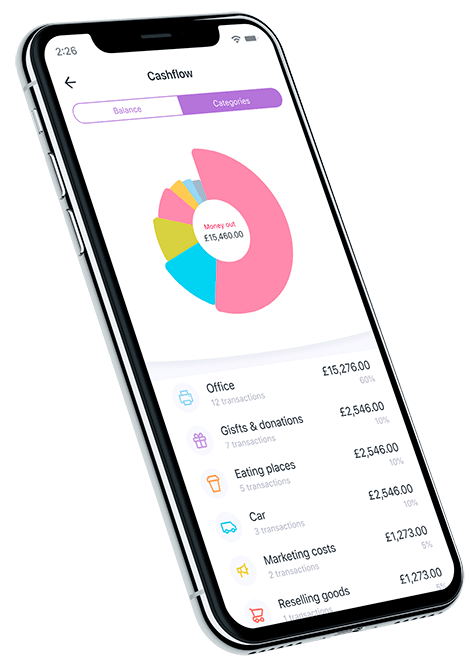

Expense categorisation

Anyone with the Amaiz app can sort their expenses on the go. Immediate categorisation of transactions and the ability to upload or take a photo of receipts and invoices takes the sting out of tax deadlines when they come around.

Download now!

And you can open a business account with all the support you need in minutes.