Expense categorisation for self-employed

So you run your own business, which is a great feat achieved, and along with that comes the unavoidable intricacy of dealing with your business’ taxes.

Being self-employed is stylish. Making your own schedule, setting business goals, having control over your income, these are all things that are slightly less attractive.

Filing your Self Assessment tax return might seem like a daunting task, but it can be made easier by keeping rigorous accounting records of your expenditures, as well as by breaking down those expenses into recognizable categories that will help you determine which HMRC will allow as a business expenditure and which it won’t.

What is a Self Assessment tax return?

Income tax is usually removed directly from your wages. But if you are self-employed, your wages aren’t provided in a linear fashion. You provide a product or service on your own basis, and you report whatever you earn off that to HMRC. This gets slightly more complicated when you add in any purchase of required materials to make your product or service. Expenses that your employer would normally cover if you worked for someone else, are now your responsibility. In the Self Assessment tax return, you will introduce all of the expenses that you pay to run your business and work out your taxable profit.

How is taxable profit determined?

How much of your profit can be taxed is determined through adding up the costs of running your business. Naturally, you’ll need to keep accurate records of your expenditures so that this calculation is more straightforward. In other words, allowable expenses are deducted from your gross profit to get your taxable profit.

What are allowable expenses?

- Cost of Sales

- Business Expenses

- Cost of Equipment

How much a business owner spends in each category depends on the type and size of their business, but each category will be discussed with regards to how it pertains to your Self Assessment tax return.

So then, what are disallowable expenses?

Conversely to allowable expenses, disallowable expenses include any expenses not incurred wholly and exclusively for business purposes. Let’s break it down even further and examine what allowable and disallowable expenses are in each category.

What is Cost of Sales?

Cost of Sales is any expense incurred in obtaining or creating your product or service. This could include any stock purchased for your business, raw materials needed, any labour needed that is not your own, and other production costs. These are costs that pertain to buying items that you resell to your clients in the process of making your product or carrying out your service.

What counts as business expenses?

Any expenses that are incurred to produce the goods or services that your business provides can be classified as business expenses. An expense is only allowable for tax purposes if it's incurred ‘wholly and exclusively’ for the purposes of conducting your business.

The expenses your business incurs will depend on the industry your business operates in, the stage that your business is at and other factors that relate to the operation of your business.

Below you’ll find some practical and common approaches to making sense of your business expenses.

Fixed vs variable

Every business owner must keep track of their daily, monthly, and recurring business expenses. Some expenses will be fixed, and some will vary depending on how many sales your business is doing.

- Fixed Expenses—an optimal way to estimate your fixed costs is to look back on your previous months’ expenses and use this to forecast your expenses for a future period. You will most likely have to assess your fixed costs such as rent, business rates, utility bills, employee salaries, employer’s NI, software subscriptions, mobile phone bills, and professional fees for solicitors and accountants, for example. Most fixed costs generally won’t change much, but there are other factors which may cause these fixed costs to change. For example, if you are planning to grow your business over the forthcoming year, these fixed costs may change. Fixed costs are usually paid on a recurring basis (weekly, monthly, quarterly, or annually).

- Variable Expenses—these will increase or decrease depending on how well your business is doing. For example, if you are an online retailer importing goods from abroad to sell online in the UK, the more products you sell, the more postage and packaging costs you will have to pay if you offer free delivery to your customers and this will have a direct impact on your variable costs.

Capital expenditure vs operational expenses

There are two types of expenses that a business will incur: capital expenses (CapEx) and operational expenses (OpEx). Capital expenses are expenses that are incurred to purchase tangible or intangible assets. Capital expenses provide future economic benefits to the business and are normally kept in the business for more than one accounting period. Any expense that is capitalised will need to be depreciated over its useful economic life (how long you expect to use the asset for). Examples of capital expenses include the cost to buy machinery, computers, software, etc.

Operational expenses, on the other hand, are all regular expenses that are unlikely to have future benefits and these are expenses that your company has to make to maintain its daily operations. Examples of operational expenses include rent, employee salaries, travel expenses.

Capital Expenses vs Operating Expenses

- Pupose: Assets purchased with a useful life beyond current year

- When Paid: Lump sum up front

- When Accounted For: Over 3-10 year lifespan while asset depreciates

- Listed As: Property or equipment

- Tax Treatment: Deducted over time as asset depreciates

- Pupose: Ongoing costs to run a business

- When Paid: Monthly or annual recurring

- When Accounted For: In the current month or year

- Listed As: Operating Cost

- Tax Treatment: Deducted in the current tax year

When filing your tax return, you would normally list operational expenses under the "Allowable business expenses" section, which would fall under the following subcategories:

Costs of goods bought for resale or goods used

- Car, van and travel expenses – after private use proportion

- Wages, salaries and other staff costs

- Rent, rates, power and insurance costs

- Repairs and maintenance of property and equipment

- Accountancy, legal and other professional fees

- Interest and bank and credit card financial charges

- Phone, fax, stationery and other office costs

- Other allowable business expenses – client entertaining costs are not an allowable expense

Capital expenditure is listed under "Tax allowances for vehicles and equipment (capital allowances)". Allowable expenses include:

- vans and cars

- tools and computers

- shelves, furniture and electrical fittings

There are, however, some greyer areas, so when in doubt ping our accountancy experts via the in-app chat if you have an account with us or right from the website if you don't. They will point you in the right direction.

Because this category carries more nuance than the other two, we’ve made a handy chart showing what falls in each category.

| Cost | Allowable Expenses | Disallowable Expenses |

| Travel | Any travel costs incurred while travelling to your clients, on a business trip, travelling to training courses, or any business places that you need in the course of running your business, such as banks or accountants. | If your place of business is not your home or near your home, the normal cost of commute is not allowable. |

| Motor Expenses | If you use a car in the course of your business, allowable expenses include maintenance and upkeep on the car, licensing and registration, as well as mileage. | The cost of the car, any use of the car that is not for business purposes |

| Mileage | If you split the use of your car between personal and business, you’ll need to keep a detailed log showing all trips pertaining to the business use. | Any mileage spent on personal use and not business. |

| Employee costs | If you employ others to work for you, allowable expenses for your business will include their salary, employer’s national insurance, and any benefits you give them. You’ll need to be running a recognized payroll scheme and report monthly to HMRC. | A nanny is not allowable even though hiring help may allow you to work. |

| Entertainment | Necessary subsistence costs in the course of the journey like buying yourself food while out visiting clients so long as they aren’t lavish. Up to £150 per employee in the year provided that it is wholly and exclusively for the purposes of the trade, such as a yearly event. |

The cost of entertaining a client or paying for the lunch of a prospective business partner. |

| Insurance | The cost of insuring the business | - |

| Premises costs | Lease of business premises | If you built or purchased the building for your business |

| Working from home | Allowance for using your home as your workplace, different calculation methods for different space usage | You can’t change methods of calculating total spent working from home |

| Advertising and promotion | In order to gain more business, includes all mediums of promotional materials, networking, and marketing | - |

| Clothing | Embroidered uniforms, protective clothing and footwear | General work clothing |

| Legal and Professional fees | Most of the fees are allowable except those specified in disallowable | Cost in relation to the purchase of large items, settling tax disputes, fines for breaking the law and creating/filing tax returns. Also, speeding tickets and parking fines for a business |

| Accounting and Bookkeeping Fees | On the whole, allowable | Any fees payable to completing tax returns, the set up costs of forming a company. |

| Training | Any expenditure on training to update skills or keep up with your continuing professional development. | Training for a new skill for a different business |

| Bank interest and finance charges | Bank overdraft and credit card charges, hire purchase interest and leasing payments | Actual repayment of the lump sum amounts |

| Phone and internet costs | Cost of calls, internet | The cost of personal calls |

| General business costs | Items required to run the business such as stationary, postage, small office equipment, computer software, subscriptions, etc. | Any cost not incurred wholly and exclusively for the business |

What is the cost of equipment?

Cost of Equipment includes any expensive machinery required to make your product or sell your service that is rented or purchased. These items must last for a significant amount of time, over two years, and have reasonable value (over £250). It can include furniture for your office, any expensive equipment used in your business, and computer equipment like printers, laptops, or tablets. This type of cost won’t be deducted fully, but rather you would recognize the cost over the useful life of the asset. You can claim capital allowances on the costs of purchasing and improving equipment such as:

- vans and cars

- tools and computers

- shelves, furniture and electrical fittings

The type of capital allowance and amount you can claim will depend on your assets and other circumstances. See this comprehensive guide on the gov.uk website for more information.

Simplified expenses if self-employed

If you’re not one to sit for hours working out the mathematical actual costs of using your vehicle for business, working from your home, or living in your business premises, then there is an option for you.

If you are a sole trader or in a business partnership that has no companies as a partner, you’re eligible to use simplified expenses. Simplified expenses are a way of calculating some of your business expenses using flat rates instead of working out your actual business costs.

Using simplified expenses

You first need to make sure you record business miles for vehicles, any hours you work at home, and how many people live at your business premises over the year. At the end of the tax year, you can use the flat rates for vehicles, working from home, and living at your business premises to work out your expenses. Then, you’ll need to include these amounts in the total for your expenses in your HMRC Self Assessment tax return.

How do I file my HRMC Self Assessment tax return?

You can file your tax return online or in paper form. If you’ve never sent in an online tax return, you’ll need to allow extra time as you need to register first and set up your tax return login. The next thing you’ll need is your records. Hopefully, you keep bank statements and receipts so that correctly filling in your online return is easier. Once you use your records to fill in your tax return online, HMRC will calculate what you owe based on what your report. You can find more information on Self Assessment deadline and important dates on the gov.uk website at this link here.

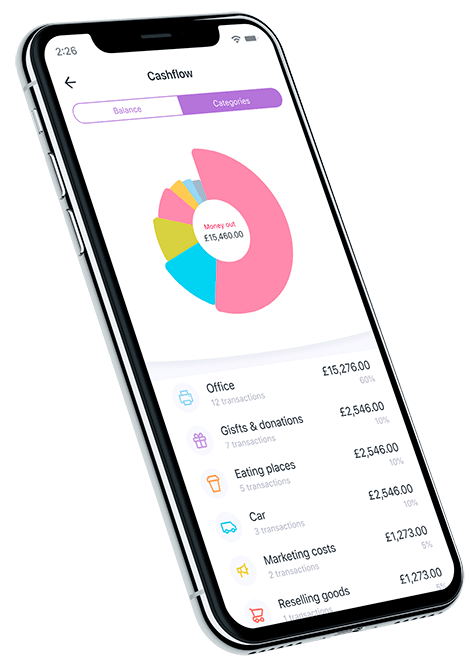

Use our built-in expense categorisation feature to help categorise your expenses as you come across them. Category breakdown chart can be used to: keep track of where your business may be overspending week-to-week, month-to-month—this will help you to allocate the resources, plan for the future and change course if necessary. Keeping your books organised in this way will be of help once Self Assessment time is upon you, so you can always be sure your Self Assessment form is in order.

Download now!

And you can open a business account with all the support you need in minutes.