Covid-19 Update: Government Support for the Self-Employed

The Chancellor put a safety net under the self-employed this week, with the promise of a lump sum payment, although this won’t be available for some months. What does that mean for you and what should you do now?

What’s on the table?

- A taxable grant of no more than £2,500 a month for at least three months

- Available to anyone with trading profits of £50,000 and under

- Self-employment needs to be your main source of income

- Precise figures will be calculated at 80% of the average monthly profits accumulated over the last three years (or less if you’re a newer business)

- Automatic qualification if you submitted a 2018/9 Self Assessment tax return - but you will need to apply

- If you haven’t filed your tax yet, you have four weeks from the 26th of March to submit and qualify for the scheme

- Three months’ backdated grant will be paid straight into your bank account by the middle of June.

With Thursday’s announcement, Chancellor Rishi Sunak finally told the self-employed: "You have not been forgotten”, and outlined plans for nearly 4 million sole traders to be given grants worth 80% of their average monthly profits. However, it features considerable caveats that will particularly affect those who’ve recently registered as self-employed.

The Coronavirus Self-employment Income Support Scheme is available for anyone who was trading in 2018/19 and is still in business today, as long as that self-employment makes up the bulk of their income (over 50%). The scheme is open to businesses with profits of less than £50,000 in 2018-19, or an average trading profit of less than £50,000 from 2016-17, 2017-18 and 2018-19.

The Chancellor has stated that this will cover 95% of the self-employed who make the majority of their money from self-employment.

How you can claim

- HM Revenue and Customs (HMRC) will use your existing information to find out if you’re eligible

- There is no need to contact HMRC. They will contact you to confirm that you meet the criteria

- Money will be paid straight into a bank account, which you will need to confirm on your application form, once you’ve confirmed your eligibility

What help is there if you’ve dipped out?

Unfortunately, If you’ve recently turned self-employed and do not have a full year’s worth of accounts you are not covered by the scheme. Similarly, if you run a Limited Company and usually pay yourself a combination of salary and dividends you will only have 80% of your salary covered by the Coronavirus Job Retention Scheme if you operate via PAYE.

Towards the end of his statement, the chancellor also suggested that tax breaks for the self-employed, such as lower National Insurance, could end in the future.

Things you should do now

- Consider applying for universal credit - just under £100 a week

- Look to defer upcoming Self Assessment income tax payments for 6 months

- Stay tuned for further announcements from Amaiz

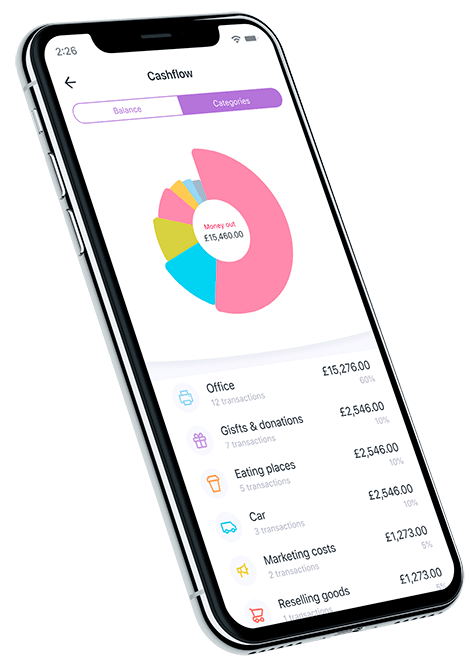

We’re advising our members to keep careful records of their trading activities this year in case the qualifying rules change - or if future tax returns feature a mechanism to get a backdated compensation payment. Make sure you’re making use of the receipt categorisation in your Amaiz app.

Download now!

And you can open a business account with all the support you need in minutes.