Chargebacks VS Refunds: What's the Difference and Why it Matters

Did you know that confusing billing descriptors lead to over £128 million in chargebacks annually for UK merchants? That’s a staggering loss - especially when many of those chargebacks could be prevented with clearer communication and better transaction transparency.

Whether you're running a startup or a growing e-commerce brand, understanding how refunds and chargebacks differ isn't just useful - it could protect your business.

Let’s break it down in plain English: what refunds and chargebacks actually are, how they work in the UK, and what you should do when they appear in your business.

What Is a Refund?

A refund is the most straightforward option. It happens when a customer contacts you - the business - directly and asks for their money back. Maybe the item was faulty, didn’t arrive, or they simply changed their mind and your policy allows it.

Key facts:

- You (the merchant) process the refund directly

- It’s usually quick - a few days at most

- You stay in control of the process

- Minimal extra costs beyond the returned payment

What Is a Chargeback?

A chargeback occurs when the customer skips contacting you and instead goes straight to their bank. They ask the bank to reverse the charge due to issues like unauthorised transactions, non-delivery, or item mismatch.

Key facts:

- The bank/card issuer investigates and decides the outcome

- You may have to provide proof (shipping records, communication)

- Resolution can take weeks or months

- Fees may apply

- Repeated chargebacks harm your merchant reputation and could lead to account restrictions

Chargeback vs Refund: The Main Differences

What UK Businesses Should Watch Out For

If you run a UK business, especially online, chargebacks can catch you off-guard. Many are triggered by issues that could've been resolved with a quick response or a visible refund policy.

Tips to protect your business:

- Make your billing name clear on bank statements

- Respond to support queries promptly

- Keep proof of delivery and communication

- Maintain a clear, visible refund policy

- Use secure payment systems and fraud detection tools.

Final Thoughts

Chargebacks and refunds might seem similar, but they’re vastly different behind the scenes. Refunds are faster, cheaper, and easier to manage. Chargebacks, while necessary in some cases, can damage your business if mishandled.

For UK merchants - especially SMEs -being proactive can significantly reduce losses and safeguard customer relationships. Invest in clear communication, accurate billing descriptors, and transparent service. It could save you more than just money.

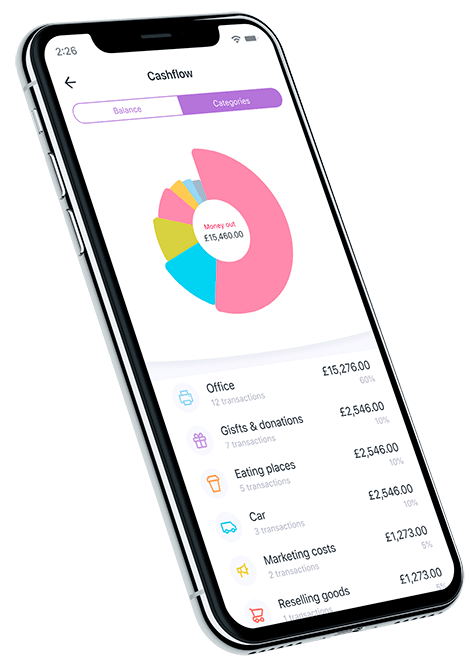

Download now!

And you can open a business account with all the support you need in minutes.