Bank Accounts For Startups: How To Choose The Right One

With over 800,000 new businesses launched in the UK last year [1], how you manage your money can mean the difference between success and failure. According to the Startup Statistics 2024 UK – Startup Success and Failure Rates report, the majority of start-ups fail within the first four years [2].

Choosing the right business bank account for your startup is one of the first and most important decisions you’ll make.

It’s not just about storing your business’s money. It’s about building a strong financial foundation to manage cash flow, handle payments efficiently, and earn investors’ trust.

Let’s explore why selecting the right business current account is essential for your startup’s growth.

Why Your Startup Needs a Business Current Account

While it might seem easier to use your personal bank account when starting out, mixing personal and business finances is a recipe for confusion - and legal risk.

HMRC requires clear separation between personal and business accounts, and failure to comply can lead to audits and penalties [3].

A business current account helps keep finances organised, simplifies tax reporting, and offers important legal protections.

When you start raising funds, having a dedicated business account becomes even more critical.

Investors demand transparency - a proper account shows professionalism and builds credibility.

What to Look for in a Startup Business Bank Account

Choosing the right account isn’t always straightforward. Here’s what to consider:

Decide What Services You Need. Not every bank offers what startups require. Some accounts don’t support SWIFT or SEPA payments. Others won’t issue corporate cards or allow accountant access. Pick a bank that supports the way you operate - today and as you grow.

Watch Out for Hidden Fees. Every penny counts in the early days. Pay close attention to monthly fees, transaction charges, and ATM withdrawal costs. Choosing an account with lower fees helps preserve cash to reinvest in your business.

Ensure Easy Access to Your Money. Instant access to your funds is crucial. Look for a provider offering excellent online banking and mobile app support so you can monitor balances, make transfers, and manage payments anytime, anywhere.

Global Payment Capabilities (SEPA, SWIFT, and FPS). Planning to work internationally? Choose a business bank account that supports SEPA, SWIFT, and FPS transfers. These payment networks allow you to send and receive money across borders quickly and affordably - essential for growing internationally.

Why Startups Choose Amaiz for Business Banking?

At Amaiz, we’re more than just a business account provider - we help startups manage their money smarter, faster, and with greater flexibility.

With access to GBP and EUR business accounts, managed straight from your phone or computer, you’ll be free to focus on running your business, not running to the bank.

Our Business Account Features Include:

- Virtual and Physical Payment Cards. Issue up to 10,000 cards per month with seamless API integration for easy and scalable card management - ideal for startups and companies growing their operations.

- Fast Global Payments. Send and receive funds internationally with SEPA, SWIFT, and FPS transfers, including options for bulk (mass) payments - perfect for businesses managing multiple suppliers or remote teams.

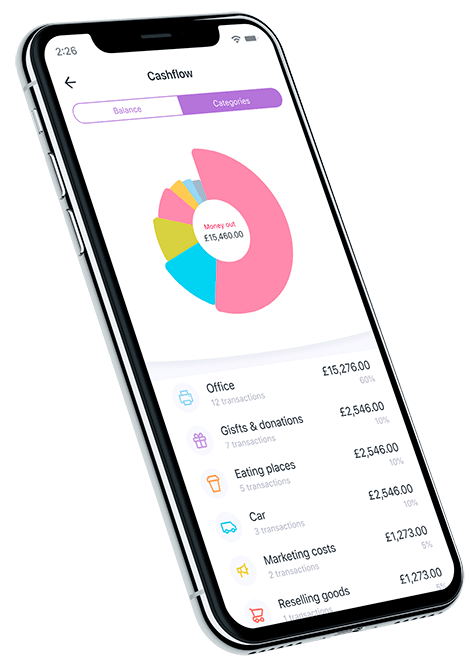

- Complete Financial Control with Our Business Account App. Manage your entire business account securely from our mobile and web app - track balances, send payments, and oversee expenses anytime, anywhere.

- Crypto-Friendly Business Banking. Accept fiat currency from crypto exchanges easily. Our business accounts support crypto-connected startups and companies, providing simple, compliant access to traditional banking.

- Flexible Onboarding for International Teams. Have UBOs or directors from abroad? No problem. Our wide acceptance policy welcomes international structures, helping startups and SMEs set up a compliant business account with ease. If you are launching your company from overseas, you can learn more about how to open a UK business account without living in the UK.

Whether you’re working with clients in the UK or expanding into Europe and beyond, Amaiz empowers you to manage your business finances securely and affordably.

Start Growing Your Business with Amaiz Today. Growing a startup is challenging enough - banking shouldn’t be. Let Amaiz handle your financial operations so you can stay focused on scaling your success.

👉 Apply for your Amaiz business account online and take the first step towards smarter startup banking.

[1] 2025 Review of UK Company Formations -[https://www.informdirect.co.uk/company-formations-2024/].

[2] The Startup Statistics 2024 UK – Startup Success and Failure Rates - [https://archimediaaccounts.co.uk/startup-statistics-uk/].

[3] HMRC Guidance on Record Keeping - [https://www.gov.uk/keeping-your-pay-tax-records].

Download now!

And you can open a business account with all the support you need in minutes.