A Guide to Virtual Card API and Money Transfers API

First things first, let's clarify what API stands for. Application Programming Interface, or API, acts as an intermediary, enabling smooth communication between two applications. APIs provide a method for extracting and exchanging data both within and across organisations, simplifying complex processes.

What are the Benefits of API Integration in Banking?

In banking, APIs are essential as they serve as a bridge between online banking systems and third-party services. They are integral in various functions such as payment processing, analytics, and account authentication, among others. By facilitating these connections, APIs enhance the functionality and reach of banking platforms, allowing them to operate more efficiently and effectively in today's digital landscape.

API has become an important part of modern business because of the benefits that it creates. APIs can integrate with new technologies such as IoT and chatbots. Many industries have adopted APIs to increase their digital transformation. The fastest-growing type of data in 2021 was API data which grew by more than 20%, according to Cloudflare [1]. Forbes article from 2022 claims that the market capitalisation of companies that have adopted APIs has grown by more than 12% compared to those that have not adopted APIs [2]. And according to McKinsey the number of APIs deployed in the banking sector is anticipated to increase by 100% from 2022 to 2027 [3].

The global API economy is expected to reach $267 billion by 2025 - APIToolKit says [4]. And it’s not at all surprising - API’s offer a number of benefits when it comes to finance.

APIs help streamline communication and data sharing between systems, improving operational efficiency and reducing manual tasks. Survey by MuleSoft determined that 84% of businesses use APIs [5] and according to the Slashdata Developer Economics Survey 19th edition, nearly 90% of developers are using APIs in some capacity [6]. API’s safeguard sensitive financial information with secure connections and encrypted data transmission. Having access to real-time financial data is another benefit, empowering faster decision-making based on accurate insights.

According to an article by APItoolKIt, APIs can help businesses reduce costs by 15% and businesses that use APIs are 24% more likely to be profitable than those that don't. The same article claims that APIs can help businesses improve customer satisfaction by 20% [4]. Clearly, the integration of APIs is transformative for the banking industry.

Exploring Amaiz’ API integration

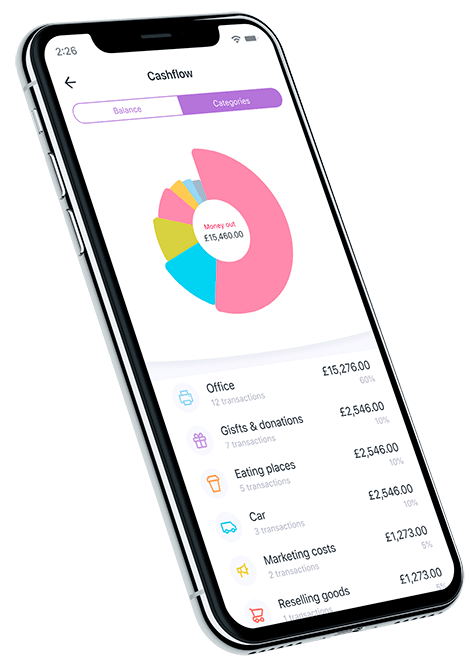

To streamline operations, enhance security, and boost customer satisfaction Amaiz offers 2 main options for API integration - Card Management API and Transfer Management API. Let's take a closer look at these options to see how they can improve your business.

What is a Card Management API?

A Card API allows businesses to create and manage payment cards related to your business. You can view a list of all cards, sorted by creation date in descending order, with pagination support for easy navigation. Additionally, this API allows to issue new cards linked to specific wallets and currencies, with detailed responses including card ID, activation status, and creation timestamps. Users can also retrieve detailed information about a card, including security details like the card number, expiry date, and CVC2, as well as check the balance of a card, providing a comprehensive overview of card status and financials.

What is a Money Transfers API?

A Money Transfers API enables businesses to facilitate financial transactions. Here are some key functionalities supported by the transfers API: it returns the exchange rate between two specified currencies, shows the list of supported countries and currencies, sends X-Currency transfer, sends money to another wallet, it also calculates transfer commission, provides a list of wallets for the current user and even the list of transactions for the specified wallet.

How to integrate Amaiz’s Virtual Card API and Money Transfers API?

First, you need to complete the onboarding process. To apply for an account, follow this link. Once you have completed the onboarding, our team will guide you through the API integration process.

For more details, you can also check our API documentation: Card Management API and Money Transfers API.

If you have any questions or need further assistance, our support team is here to help. Just send us a quick message via chat.

1 - Cloudflare article ‘Landscape of API Traffic’ by Daniele Molteni - 2022-01-26 - [https://blog.cloudflare.com/landscape-of-api-traffic/].

2 - Forbes article ‘Research Shows Managed APIs Fuel Growth: Here’s Why’ by Julien Rateau - 2022-01-19 - [https://www.forbes.com/sites/googlecloud/2022/01/19/research-shows-api-management-fuels-growth-heres-why/?sh=16659cf61713].

3 - McKinsey article ‘What’s new in banking API programs’ by Malin Fiedler, Timo Mauerhoefer, Nils Motsch, and Henning Soller - 2022-01-18 - [https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/tech-forward/rethinking-conventional-wisdom-future-of-digital-tech-infrastructure].

4 - APItoolKit article ‘Key Benefits of API Integration for Developers (with Statistics)’ - 2023-10-25 - [https://apitoolkit.io/blog/benefits-of-api-integration/].

5 - Mulesoft survey ‘MuleSoft Survey Finds Connectivity Is Driving Business Strategy’ - 2015-07-29 - [https://www.mulesoft.com/press-center/businesses-embracing-cloud-mobile-microservices-iot].

6 - Developer Nation research paper ‘State of the Developer Nation 19th Edition - Q3 2020’ - 2020-10-11 - [https://developernation.net/resources/reports/state-of-the-developer-nation-q3-2020/].

#Amaiz #API #Banking #Fintech #OnlineBanking #b2b #bankingsolutions #businessbanking #bankaccounts #virtualcards #iban #ApplicationProgrammingInterface

Download now!

And you can open a business account with all the support you need in minutes.