1 in 3 Micro-businesses Risk Breaking Tax Rules by Failing to Separate their Personal and Business Bank Accounts

Amaiz Accountant Urges Businesses to Improve their Admin During the Lockdown

A survey carried out by 3Gem for Amaiz, the new business app, has revealed that just over 30% of micro-businesses don’t have a separate business bank account. These businesses risk muddling business and personal expenditure and breaking tax rules. The survey also found that 44% of micro-businesses are usually spending at least 3 hours a week on admin, with one in five spending around a day a week on getting the books in order. New apps with banking services, such as Amaiz, would reduce this burden considerably. The lock down is the perfect time to make the transition.

500 micro businesses were asked about their challenges with managing their business in order to help Amaiz prioritise the services they offer on their new app (launched last year), that combines bookkeeping and banking tools.

Jayesh Gajparia a certified accountant at Amaiz explained; “You don't legally need a dedicated business account, unless you’re a limited company, but there are several advantages to having one. For a start, there is a huge risk that you will muddle your personal and business costs and break tax rules without a dedicated business account, as it’s far more difficult to separate expenditure out. A business separate account also helps you locate electronic receipts and prepare for self-assessment.”

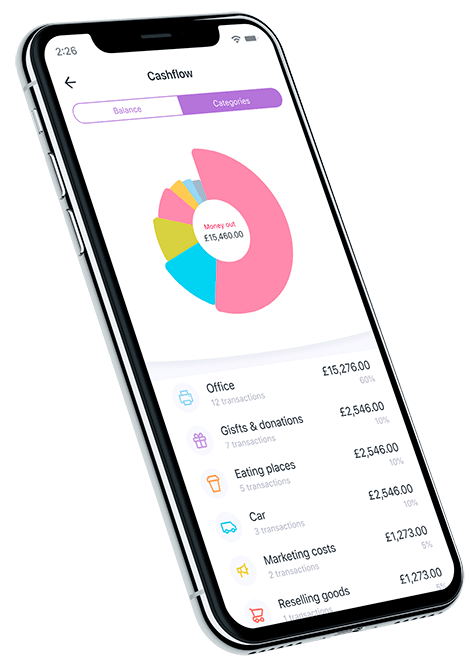

Modern business bank accounts now make it far easier to identify business-related

expenses and get a clearer understanding of how your company is performing. Most personal current accounts don’t supply the functionality and options that a good banking app will have.

Jay concluded;

“Normally small business owners are working really hard just to keep up with the needs of their customers and manage the business. I can understand why they don’t give this priority, but now is a great opportunity to review how the business works and put in place new systems to make life easier once the business is operating again. One of the key ones should be to open a business bank account that gives you the chance to manage your bookkeeping on the go. This will save businesses up to a day a week in admin.”

In addition to combining payment services with bookkeeping Amaiz gives you access to 24/7 support and the chance to question the Amaiz accountant.

To help business owners during this difficult time Amaiz is offering the following:

- One month fee freeze for Starter plan users (no 20p transaction charge).

- One extra month for Advanced plan users (£9.99 fee waived).

- Users currently in their opening trial month will have this extended by a month afterwards.

About Amaiz

Amaiz is on a mission to transform the lives of small businesses and sole traders by providing quick and easy bpayment and receipt management in one app. Amaiz combines the features of accountancy software with online banking like features so that all can be automated and carried out ‘on the go’.

Amaiz Ltd is an e-money institution under UK Electronic Money Regulations 2011. It is authorised and regulated by the Financial Conduct Authority and is a registered agent of PrePay Technologies Limited which is an electronic money institution authorised by the Financial Conduct Authority for the issuing of electronic money and payment instruments.

For more information please visit www.amaiz.com

About the Survey

The survey was carried out by 3Gem in February 2020. 500 responses were received from sole traders and micro business owners across the UK.

Media Enquiries

For interviews, images and further information please contact:

Onyx, on behalf of Amaiz

Email: anne@onyxcomms.com

Download now!

And you can open a business account with all the support you need in minutes.